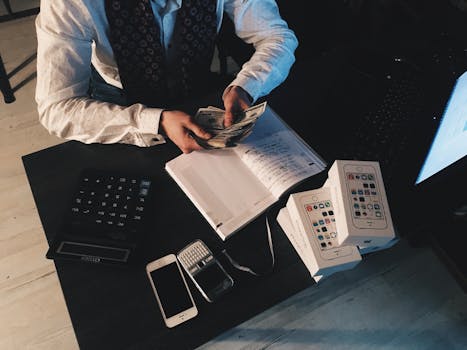

In your 20s, building a solid financial foundation is crucial for achieving future wealth and security. The habits you adopt during this decade can significantly impact your financial trajectory for years to come. This article explores the best financial habits to adopt in your 20s, ensuring you set yourself up for success.

Why Financial Habits Matter

Establishing financial habits in your 20s can lead to increased wealth, reduced stress, and better financial decision-making in your later years. These habits help you understand your financial situation, make informed choices, and ultimately gain control over your finances. Here are a few reasons why these habits are essential:

- Compounding Interest: Starting to save early takes advantage of compound interest, allowing your money to grow exponentially over time.

- Debt Management: Developing good habits helps you avoid or effectively manage debt, crucial in your 20s when many face student loans or credit card debts.

- Future Security: Good financial habits lead to a more secure future, providing a safety net for unexpected expenses.

1. Create a Budget and Stick to It

One of the most important financial habits to adopt in your 20s is creating a comprehensive budget. A budget helps you track your income and expenses and ensures that you are living within your means. Here’s how to get started:

- Identify your sources of income.

- List all your expenses, including rent, utilities, groceries, and entertainment.

- Set limits for each category to avoid overspending.

- Review and adjust your budget monthly to reflect changes in income or expenses.

2. Build an Emergency Fund

An emergency fund is a financial safety net that protects you from unexpected expenses, such as medical bills or car repairs. Aim to save at least three to six months’ worth of living expenses. Here are some tips for building your emergency fund:

- Set a specific savings goal.

- Automate transfers to your savings account each month.

- Use windfalls (like tax refunds or bonuses) to boost your savings.

3. Pay Off Debt Aggressively

If you have student loans or credit card debt, it’s essential to develop a plan for paying off debt aggressively. Here are strategies to consider:

- Prioritize high-interest debt to minimize costs over time.

- Consider the snowball method, paying off the smallest debts first for quick wins.

- Look for opportunities to refinance for better interest rates.

4. Start Investing Early

Investing in your 20s is one of the best ways to build wealth over time. The earlier you start, the more your money can grow due to compounding returns. Here are some tips to begin investing:

- Start with a retirement account, such as a 401(k) or IRA.

- Diversify your investments across stocks, bonds, and mutual funds.

- Consider using robo-advisors if you’re a beginner for guided investment options.

5. Educate Yourself About Personal Finance

Continuous education is key to making informed financial decisions. Make it a habit to read books, take online courses, or listen to podcasts focused on finance. Suggested topics include:

- Budgeting and saving strategies.

- Investing basics.

- Debt management techniques.

6. Understand Your Credit Score

Your credit score significantly impacts your financial health, influencing your ability to borrow money, get a mortgage, or even secure a job. Here’s how you can manage your credit score:

- Check your credit report regularly for errors.

- Make timely payments on loans and credit cards.

- Avoid taking on too much debt, as this can lower your score.

7. Set Financial Goals

Establishing short-term and long-term financial goals gives you direction and motivation. Consider using the SMART criteria (Specific, Measurable, Achievable, Relevant, Time-bound) when setting your goals. Examples of financial goals include:

- Saving for a down payment on a home.

- Planning a vacation.

- Building a retirement fund.

8. Network and Build Relationships

Networking can positively impact your financial success. Building professional relationships can open doors to new job opportunities and personal growth, leading to financial rewards. Strategies include:

- Attend industry events and seminars.

- Join professional organizations relevant to your career.

- Connect with mentors who can provide guidance and advice.

9. Live Within Your Means

It’s easy to get caught up in lifestyle inflation when you start earning more money. However, living within your means is crucial for financial stability. Here are ways to practice this habit:

- Avoid impulse purchases by implementing a waiting period for non-essential items.

- Identify needs versus wants, and prioritize accordingly.

- Seek affordable alternatives to costly entertainment or dining options.

10. Review and Adjust Your Financial Plan Regularly

Your financial situation and goals may change over time, making it necessary to review and adjust your financial plan regularly. Consider monthly or quarterly check-ins to assess your progress. Important aspects to review include:

- Your budget for accuracy.

- Your savings and investment performance.

- Any changes in your financial goals or circumstances.

Conclusion

Adopting good financial habits in your 20s sets the stage for a secure and prosperous future. By following these tips, you can build wealth, establish financial security, and reach your long-term goals. Start today, and watch your efforts transform your financial landscape over the coming years.

Remember, the choices you make today can profoundly affect your financial trajectory in the future. Make your 20s count by cultivating the best financial practices that lead to lasting wealth and security.