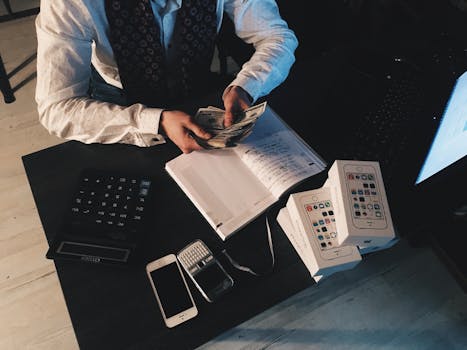

Creating a budget that truly works for your financial goals and lifestyle is an essential skill every alpha male should master. Whether you’re looking to save for retirement, pay off debts, or simply gain better control over your daily expenses, a well-crafted budget is the first step toward financial independence. In this guide, we will outline proven steps to create a budget that works not only for your wallet but also for your mindset and lifestyle.

Understanding the Importance of Budgeting

Before diving into the specifics of creating a budget, it’s essential to understand why budgeting is vital. A budget serves as a financial roadmap, helping you navigate your income and expenses effectively. Here are some reasons why budgeting is critical:

- Financial Clarity: A budget gives you a clear picture of your financial standing, helping you identify where your money goes.

- Goal Setting: With a budget, you can set goals for savings, investments, and expenditures, enabling you to focus on what truly matters.

- Debt Management: A solid budget helps you manage and pay off debts more effectively.

- Stress Reduction: Knowing where your money is going can reduce financial stress and give you peace of mind.

Step 1: Assess Your Current Financial Situation

The first step in creating a budget that works is assessing your current financial situation. This means taking a comprehensive look at your income, expenses, and debts.

- Track Your Income: List all sources of income, including your salary, bonuses, and any side jobs. This will give you a clear picture of your total income.

- Review Your Expenses: For one month, track every penny you spend. Categorize your expenses into fixed (rent, loans) and variable (entertainment, dining). This will help you see where you can cut back.

- Determine Your Debts: List all your debts, including credit cards, student loans, and car loans. Knowing how much you owe will help you strategize repayment.

Step 2: Set Financial Goals

Once you understand your financial situation, it’s time to set financial goals. Goals provide direction and motivation. Make sure your goals are SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. Here are a few examples:

- Short-term Goals: Save $5,000 for a vacation within the next year.

- Medium-term Goals: Pay off your credit card debt within 18 months.

- Long-term Goals: Save for retirement, aiming for a nest egg of $1 million by age 60.

Step 3: Choose a Budgeting Method

There are several budgeting methods available, each with its strengths. Choosing one that fits your lifestyle is crucial:

- The 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

- The Zero-Based Budget: Assign every dollar a job, making your income minus expenses equal zero. This method ensures you have a plan for every dollar.

- The Envelope System: Use envelopes for different spending categories. Once an envelope is empty, you cannot spend any more in that category.

Step 4: Create Your Budget

Now that you have a clear understanding of your financial situation, goals, and chosen budgeting method, it’s time to create your budget. Here’s how:

- List Your Income: At the top of your budget sheet, write down your total monthly income.

- Outline Your Fixed Expenses: Write down all fixed expenses, such as rent, utilities, and loan payments.

- Include Variable Expenses: Estimate your variable expenses like groceries, entertainment, and dining out.

- Add Savings and Debt Payments: Dedicate a portion of your income to savings and paying down debt.

- Balance the Budget: Ensure that your total expenses do not exceed your income. Adjust your variable expenses as necessary.

Step 5: Monitor Your Progress

Creating a budget isn’t a one-time event. To ensure your budget works, you must monitor your progress:

- Regular Reviews: Set aside time each month to review your budget. Check if you met your goals and identify areas for improvement.

- Adjust as Needed: Life changes, and so should your budget. Be flexible; adjust your budget as your income or expenses change.

- Track Your Spending: Use budgeting apps or spreadsheets to track your spending in real-time. This helps you stick to your budget more effectively.

Step 6: Stay Motivated

Staying motivated can be challenging, especially if you face setbacks. Here are some tips to keep your momentum:

- Celebrate Small Wins: Acknowledge and reward yourself when you reach a savings goal or pay off a debt.

- Visual Reminders: Use charts or apps that show your progress towards your financial goals.

- Find a Community: Join forums or social media groups where men share similar financial goals. Sharing progress can keep you accountable.

Common Budgeting Pitfalls to Avoid

Even the best budgeting plans can fail if you fall into common traps. Be aware of these pitfalls:

- Neglecting Emergency Funds: Always allocate a portion of your budget to an emergency fund to handle unexpected expenses.

- Being Too Restrictive: Allow yourself some flexibility in your budget. Being overly strict can lead to frustration and burnout.

- Ignoring Lifestyle Changes: As you grow and change, your spending should reflect your lifestyle. Don’t be afraid to make adjustments to your budget.

Making Your Budget Fit Your Lifestyle

One of the keys to having a successful budget is ensuring it aligns with your unique lifestyle. Here’s how you can customize your budget:

- Assess Your Values: Identify what truly matters to you—be it travel, fitness, or personal development—and allocate funds toward those values.

- Work-Life Balance: Ensure that your budget includes expenses for leisure activities that nourish your mind and soul.

- Experiment with Different Methods: Don’t hesitate to try different budgeting methods until you find one that suits your lifestyle best.

Conclusion

Creating a budget that works is an ongoing process that requires self-awareness, discipline, and continuous evaluation. By following these proven steps, you can take control of your finances and align them with your goals and lifestyle. Remember, a budget isn’t just about restricting spending; it’s about empowering you to make informed financial decisions that lead to a fulfilling life. Start today, and watch how a well-planned budget transforms your financial landscape.

To learn more about personal finance, goal-setting, and living an alpha lifestyle, stay tuned to our blog and share this article with those who might benefit from it!